By Jessica Domel

I hate doing my taxes. It’s not that I’m against paying my fair share to ensure our cities and government are funded. It’s that the American tax code is a complicated mess that most people don’t understand. If you ask me, the time is ripe for changing the tax code.

In fact, House Ways and Means Committee Chair Kevin Brady agrees.

After all, it shouldn’t take a calculator, math major and a crystal ball to pay your taxes each year.

We should be able to fill out our information, calculate what we owe or are owed and then send the paperwork in. Done.

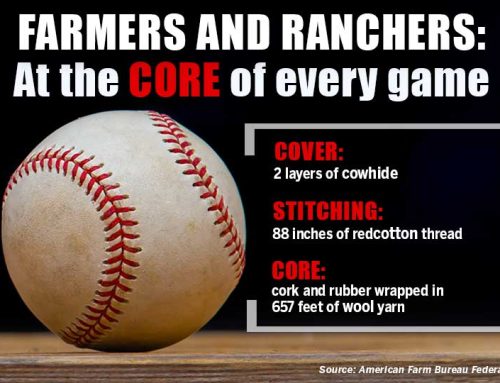

But it’s not that easy—especially for American farmers, ranchers and dairymen.

Agriculture faces special financial challenges that need to be addressed in any new tax code to ensure the men and women feeding, fueling and clothing our country can stay in business.

If we lose those people, we’ll end up paying more for our clothes, fuel and everything we eat.

I don’t think anyone wants that. I know I don’t want that.

Our federal income tax system should be fair. It should be equitable. And it should be easy to understand.

It should encourage entrepreneurship, success, savings and investments. After all, our country was founded on free enterprise. So let’s get back to the basics.

The tax code was last revised in 1986. It’s over 30 years old!

Each year, it’s been on the books, lawmakers have added pages to it. So instead of a simple outline for our taxes, we have a huge, dusty book in the back of a library that no one understands.

Talk to your lawmakers. Let them know it’s time to get back to basics. We need something that will work for American agriculture AND the American people.

Leave A Comment